Types of Stock and Bond Brokerages, Risk vs Return, and More

by Kelly R. Smith

|

Ads we feature have been independently selected and reviewed. If you make a purchase using the links included, we may earn commission, which helps support the site.

Standard Disclaimer—The author is not a financial advisor and this article is intended as educational material gained from 20 years of stock market investing. It is not intended as advice.

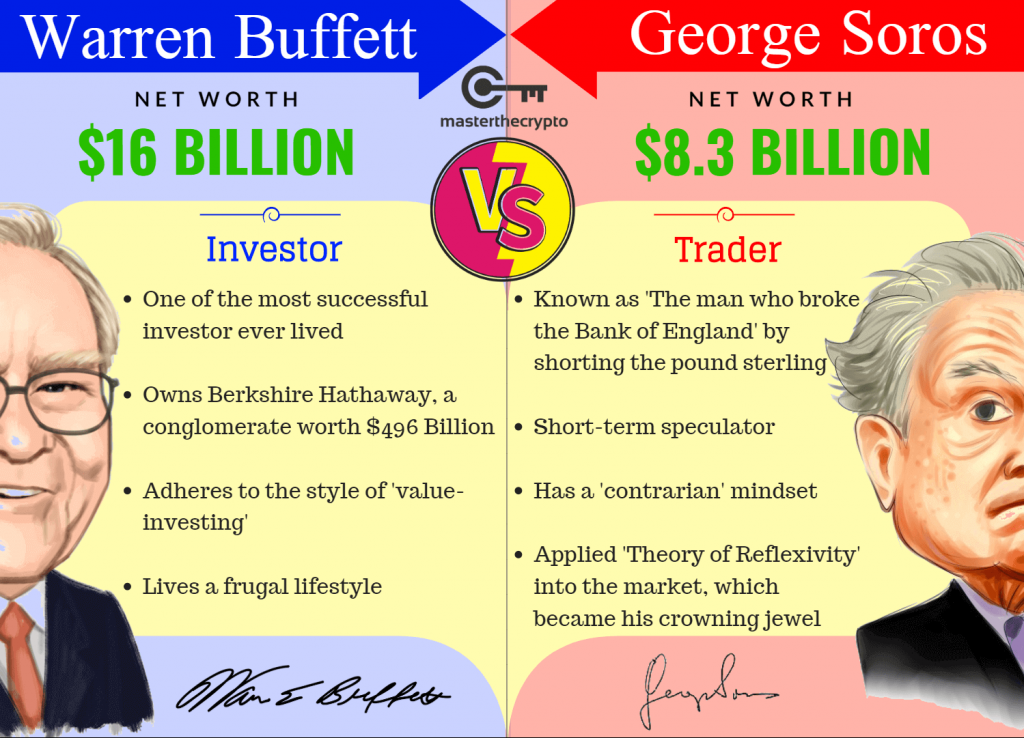

Many people still look at making financial investments for profit as a pastime that only the rich such as Warren Buffett engage in. And perhaps that was true in the past, but no longer. There has been a shift over time from pensions to self-directed retirement plans like the 401K.

These are highly managed plans; you look over a menu of funds and choose an assorted basket of funds, hopefully after doing much in-depth research. Some funds are primarily domestic, some are emerging markets, some are bonds—it goes on and on.

Most people are knowledgeable about one kind of investment–the home they pay a mortgage on and occasionally sweeten their real estate investment by remodeling or doing capital improvements like building out their basement.

Risk vs Return

As a general rule of thumb, funds and individual stock and bond returns range from high risk/high return to low risk/low return. Which is right for you? One of the most important factors to consider is how many years you are from retirement.

The most widely-accepted strategy is to begin with high risk positions when you are young with a long window of taking risks. You then re-balance your portfolio (collection of investments taken as a whole), each year so that you are taking less financial risk as you get closer to your golden years.

Choosing Between Buying Stocks or Bonds

Ideally, you want to own both; the ratio is up to you. Bonds tend to less volatile than stocks; they yield less return than stocks. But generally, when stocks are doing well, bonds perform less well and vice versa. When the market and economy burps, as it tends to do, you might want to make adjustments to your portfolio. Stocks like a bull market and bonds like a bear market.

Taking this approach has the tendency to smooth out the net worth of your portfolio, depending on whether we are experiencing a bull or a bear market. Forbes Advisor says, “According to market ‘astrology,’ a bear indicates the market is in decline while a bull signals the market is growing.”1 See the logic here? Always consider the fees that your broker charges per transaction.

As an example, when the conditions were spot-on I began acquiring Blackrock Municipal Income Fund and I did quite well with it. What makes municipal bonds so attractive? It is very stable, and of course, tax-free. There are always exceptions. Liquor, wine, and beer are called “sin stocks.” They almost always do well because as the saying goes, “people drink when the market is up because they’re happy and they drink when it’s down because they’re sad.”

You have probably voted on a “bond issue” in your community to build a new school or library. Upon approval, your city or county borrowed the money from a municipal bond fund and you and your neighbors paid it back over time with your taxes. It’s sort of like financing a vehicle.

How Much Time do You Want to Spend on Portfolio Management?

Investors come in different flavors. They vary from the timid and/or time-challenged to the type that wants to self-manage. If you’re the first type then you might stick with a relatively hands-off completely managed portfolio, like the 401K that your employer might offer.

If you are the hand-off type, keep in mind that you will be swapping convenience for potentially high management fees. Another strategy is to establish a personal account with a brokerage firm like JP Morgan Asset Management. As they say on their website, “We have a deeply resourced global network of investment professionals who take a research-driven approach analyzing every detail to uncover opportunities and risks to help our clients build stronger portfolios.”2

You will be paying for personal attention and remember that your broker is possibly more motivated by his commissions than with your profitability.

Exchange Traded Funds: What Are ETFs?

Forbes Advisor puts it this way, “Exchange traded funds (ETFs) are a type of security that combines the flexibility of stocks with the diversification of mutual funds. The exchange traded part of the name refers to how these securities are bought and sold on the market like stocks. The fund part refers to how an ETF provides easy access to diversification and exposure to a wide variety of asset classes.”3

The financial services company buys a basket of assets, stocks or bonds, currencies or commodity futures contracts, that make up the fund. Buying shares in an ETF doesn’t mean owning a portion of the underlying assets, as it would with shares of stock in a company. The financial services firm that runs the ETF owns the assets and manages them.

Invest at Your Pace with a DRIP Fund

I really like these. When I first started researching, I had rather shallow pockets meaning not much disposable income but I was eager to join in. DRIP funds (Dividend Reinvestment Plans) offer several advantages.

To begin with, they are very affordable. Brokerages operate like this: they charge a nominal fee such as $10 dollars per month for 2 trades. Unlike other types of brokerages, using this approach you can buy a percentage of a single stock. For example, if a stock is trading at $100.00/share, you can get in at half a share for a mere $50.

Another advantage is that in many cases you can sidestep a stock broker altogether and deal directly with the company you are buying into. The best way to identify participating companies is to look through a DRIP fund directory.

When your positions (individual companies you own) pay a dividend, the company (or DRIP brokerage) automatically uses it to purchase yet more percentage of shares and credits your account automatically. It is a frills-free brokerage so you must do your own research.

Play the Market like a Pro

Finally, there are on-line brokerages such as TD Ameritrade. You pay for individual trades, but again, you must do all your research. One good thing is that their on-line tools are extensive. You can drill way, way down when you are analyzing a potential position. You can trade options or you can choose from an extensive line-up of trading options including market, stop market, limit, stop limit, and more.

I hope you found something good to take away from this article on stocks and bonds, brokerages, and the risk vs return of investments.

You Might Also Enjoy:

- Remodeling Investment Cost and Return Value

- Fake News, Cognitive Ability, and Attitude Adjustment

- Chronic Fatigue Immune Deficiency Syndrome

- 8 Prepper Tips for Beginning Survivalists

- Is Tuition-Free College an American Right?

- Geothermal Energy as the Next Alternative to Oil and Gas

Resources

- Kat Tretina, Forbes Advisor, What Are Bear And Bull Markets?, https://www.forbes.com/advisor/investing/bear-market-vs-bull-market/

- J.P. Morgan, The path to stronger portfolios, https://am.jpmorgan.com/us/en/asset-management/adv/about-us/

- Miranda Marquit, Forbes Advisor, Exchange Traded Funds: What Are ETFs?, https://www.forbes.com/advisor/investing/what-are-etfs/

Looking for more great content? Visit our main site I Can Fix Up My Home or our partner sites:

I offer article and blog-writing services. Interested? Contact me for a quote!

Did you find this article helpful? Millions of readers rely on information on this blog and our main site to stay informed and find meaningful solutions. Please chip in as little as $3 to keep this site free for all.

Visit Kelly’s profile on Pinterest.

About the Author:

Kelly R. Smith is an Air Force veteran and was a commercial carpenter for 20 years before returning to night school at the University of Houston where he earned a Bachelor’s Degree in Computer Science. After working at NASA for a few years, he went on to develop software for the transportation, financial, and energy-trading industries. He has been writing, in one capacity or another, since he could hold a pencil. As a freelance writer now, he specializes in producing articles and blog content for a variety of clients. His personal blog is at I Can Fix Up My Home Blog where he muses on many different topics.

Kelly R. Smith is an Air Force veteran and was a commercial carpenter for 20 years before returning to night school at the University of Houston where he earned a Bachelor’s Degree in Computer Science. After working at NASA for a few years, he went on to develop software for the transportation, financial, and energy-trading industries. He has been writing, in one capacity or another, since he could hold a pencil. As a freelance writer now, he specializes in producing articles and blog content for a variety of clients. His personal blog is at I Can Fix Up My Home Blog where he muses on many different topics.