Calling it Build Back Better or the Reconciliation Bill; it is Still Redistribution of Wealth

|

This article was updated on 02/18/22.

Ads we feature have been independently selected and reviewed. If you make a purchase using the links included, we may earn a commission, which helps support the site. Thank you for your support.

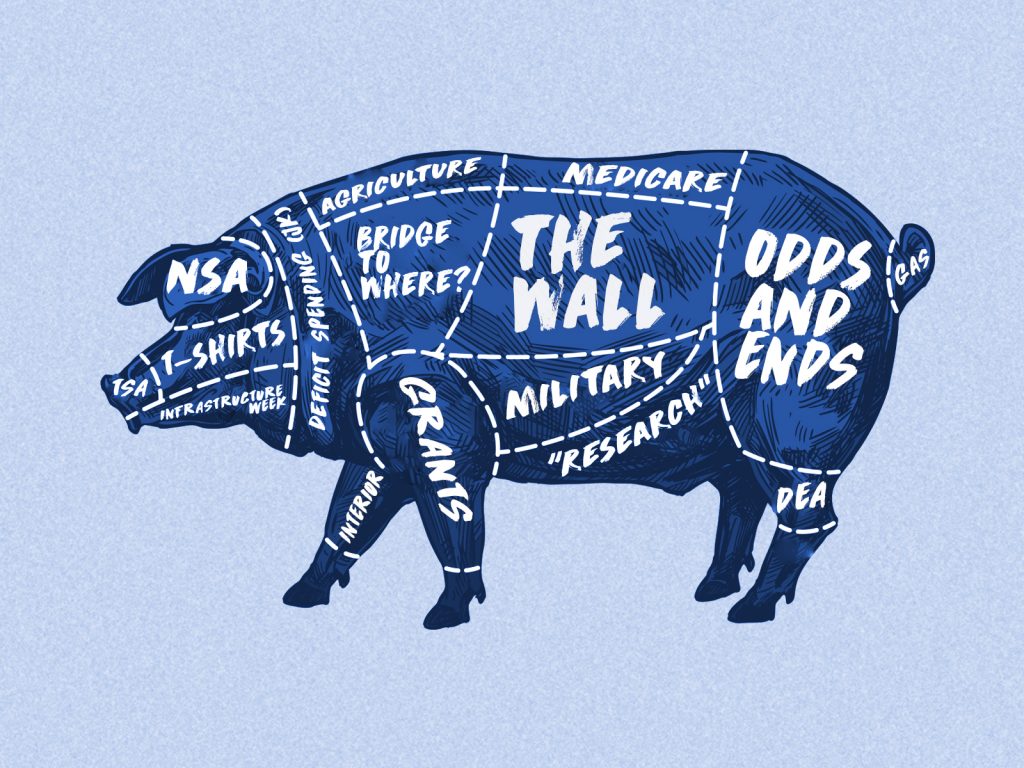

First, let’s look at what pork barrel spending is. Investopedia.com defines it this way, “Pork-barrel spending, or earmarking, is the controversial practice of directing government funding in a way that serves local businesses or other special interests. While the term has strongly negative connotations, there is no clear distinction between pork-barrel spending and funding legitimate local projects. Although House Democrats temporarily prohibited the practice in 2011, they are now revisiting the practice.1“

One obvious problem is that pork spending leverages an economic benefit to one or more particular regions involved, with the money typically going toward infrastructure and other projects that create jobs and improve quality of life. However, the effect on the rest of the country is negative, with taxpayers shouldering the cost of these pork barrel projects without receiving the benefits.

Biden’s $3.5 Trillion Build Back Better Plan

As of this writing, the “Reconciliation” package is writhing in turmoil. I don’t know about you but I can’t even conceptualize that number. When and if this behemoth financial folly passes, it will be in a trimmed-down version. There’s just too much self-serving and progressive fecal matter involved. For example

Biden’s scheme to inflate government spending by about $3.5 trillion over the next 10 years—paid for with a merging of massive tax increases and up to $1.75 trillion in new borrowing (from who, the Chinese?) will decrease future economic growth and hammer private wealth, according to a new analysis from the Penn Wharton Budget Model (PWBM), a macroeconomic forecasting project based at the University of Pennsylvania.

A CBS poll determined that a meager 10% of Americans knew “a lot of the specifics” about the Build Back Better plan (also known as the budget reconciliation bill). 29% did not know what was in it at all. Surprise!

Liberals believe an inexhaustible fund exists that can be tapped endlessly to pay for government social programs. Tax the rich and give it to a long line of moochers, pork barrel hustlers and ne’er-do-wells. These funds would otherwise have been employed as additional capital indispensable to economic progress.

James Cook

What is in the Reconciliation Bill?

Build Back Better concentrates on a long laundry list of progressive social policies and programs including education healthcare, housing, and climate. Republicans are unified in opposition so Democrats are using a special, roundabout budgetary gambit known as “reconciliation” in order to avoid the 60-vote filibuster threshold and pass the bill on a party-line vote. Why are fiscal conservatives in opposition? Here are the included provisions:

- Universal preschool for children. This is aimed at children aged three and four. Parents can either elect to sign up their children to a publicly-funded preschool program or to any number of the privately run preschool programs already available. Indoctrination begins early. Hello, Critical Race Theory.

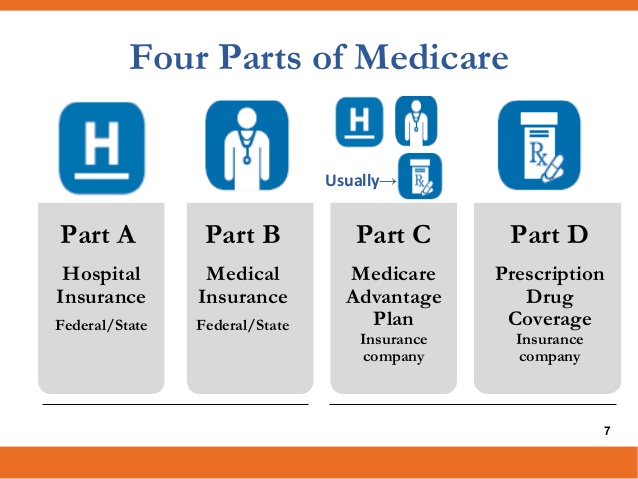

- Expanded Medicare services and Medicaid. It will expand Medicare services to take care of vision, hearing and dental health needs. As far as Medicaid goes, it will remove specific income and health limitations to allow more people to qualify for the first time.

- Lower prescription drug costs. The U.S. stands first in the cost of prescription drugs such as insulin and lisinopril. The reason? Right now, pharmaceutical companies can determine the price of drugs because the US lacks price controls. In addition to expanding Medicare services, Build Back Better would give Medicare bargaining power to negotiate the cost of prescription drugs with pharmaceutical companies for the first time to bring prices down.

- Tax cuts for families with children and childcare support. Build Back Better (here BBB is not the Better Business Bureau) would raise the current child tax credit from $2,000 to $3,000 for kids ages six and older. The new tax credit for children under the age of six would be $3,600. The credit arrives in the form of monthly checks, so that parents don’t have to pay the cost of childcare all at once. This is the intent but there is no oversight to be sure that is where the money goes.

- 12 weeks of paid family leave. Currently, the United States is the only industrialized country to not offer paid family leave, or financially compensated time off after adopting, fostering, or birthing a child. Some private companies offer this as part of a compensation package to their employees, but Biden’s plan would make sure all new working parents (and caregivers) enjoy job security and almost three full months of at least partial paid time off.

- Housing investments. This involves investing in the production, preservation and upgrading of an excess of a million affordable rental housing units and 500,000 homes for low- and middle-income aspiring homebuyers, as well as increase rental assistance agreements. How is this problematic? It puts the government in charge of a segment of the economy that rightfully belongs to private investors. Clearly, using your tax money like this is a Marxian redistribution of wealth.

- It establishes a taxpayer-funded climate army. The Civilian Climate Corps would be the largest mobilization of federal government labor after the New Deal, a massive and most likely permanent bloat of government power entrenching the radical progressive climate agenda in the bowels of our government. It would saddle taxpayers with a gargantuan debt — without any impact at all on the global climate — and allow unelected apparatchiks to shuffle your taxpayer dollars to overtly political organizations with nearly no oversight. In fact, it explicitly endorses racially oriented decision-making. This is the opposite of both equity and transparency.

- Tax cuts for electric vehicles and other climate incentives. Well, you knew this one was going to be in it, didn’t you? The term “New Green Deal” is toxic on so many levels. This is a way to sneak some of AOC’s key tenets in there. A tax credit of a minimum of $4,000 would be offered to those buying an electric vehicle (again, your tax money, Mr. and Ms worker bee). If the car is bought before 2027, enjoy an additional tax credit of $3,500. If the car was made in the U.S., there would be $4,500 added on top of that. When it’s all said and done, a taxpayer in the US can reap a maximum of $12,500 in tax credits for buying an electrical vehicle under these conditions. When Obama gave an incentive for electric vehicles, people in my neighborhood rushed out and bought golf carts.

- It penalizes reliable electric utilities for doing their jobs. According to the Texas Public Policy Foundation, “By far the furthest-reaching proposal in the bill, the Clean Electricity Performance Program aims to place financial penalties on utilities who do not meet arbitrary increases in renewable electricity generation. The plan has no provisions to ensure reliable electricity even though history has shown time and time again that increasing variable generation on the grid leads to an unstable and expensive power supply.2“

That’s Joe Biden’s pork barrel spending bill in a nutshell. You can put lipstick on that pig by calling it Build Back Better or the Reconciliation Bill but at the end of the day it will just drag the country deeper into the financial morass that we already find ourselves it. But that’s what the Marxist progressives do so well. “I’m from the government and I’m here to help.”

Check Out More Trending Content

- Democratic Socialism in America

- Energy-Efficient Green Tax Incentives to Save Money

- 10 DIY New Year Projects to Tackle

- How Bad Credit Can Stop You from Buying Your Dream Home

- Ambient Smart Wi-Fi Weather Station (product review)

- What is Critical Race Theory?

- Understanding the Basics of Medicare

- How Blood Pressure Medication Affects Your Running

- Introduction to Investing for Profit

- Al Gore– The P.T. Barnum of Climate Change

- Organic Foliar Feeding with Garrett Juice

References

- The Investopedia Team, Investopedia.com, How Does Pork Barrel Spending Hurt the Economy?, How Does Pork Barrel Spending Hurt the Economy? (investopedia.com)

- Texas Public Policy Foundation, Five Things You Should Know about the Reconciliation Bill, www.texaspolicy.com/five-things-you-should-know-about-the-reconcilliation-bill/

Looking for more great content? Visit our main page or partner sites:

I offer article and blog-writing services. Interested? Contact me for a quote!

Did you find this article helpful? Millions of readers rely on information on this blog and our main site to stay informed and find meaningful solutions. Please chip in as little as $3 to keep this site free for all.