The Four Levels of Medicare — Choose Your Healthcare Insurance

by Kelly R. Smith

|

Ads we feature have been independently selected and reviewed. If you make a purchase using the links included, we may earn a commission, which helps support the site. Thank you for your support.

This article was updated on 08/14/21.

I’m quickly approaching that age where I have to sign up for Medicare. I’m not the only one that is aware of this fact. Our names, addresses, and dates of birth are out there in the public domain and insurance companies have their eyes glued to the clock, waiting until we reach the ripe young age of 64.5. Medicare is big business. For about 4 months now I’ve been getting junk mail from various insurance companies soliciting my business. Worse than that are the phone calls; I get at least 10 per week. I usually tell them, “Don’t you know I’m on both the national and the Texas no-call lists?” They generally say, “Oh…” CLICK. No-call is one of those programs with no cojones or substance and they know it. There will be no consequences for ignoring one’s desire for privacy. No-call is analogous to that button at the crosswalk; it’s not hooked up to anything but it makes us feel better.

And then there are the ubiquitous TV commercials. The one that always gets a chuckle from me is when Joe Namath tells me, “They even provide this-n’-that for no extra charge!” Sure, nice marketing ploy, but after all, this is Capitalism at its best; The charge has already been built into the base rate. If it’s any consolation, it’s not as hosed as the model the Democrat Socialists want to morph the system into. In any event, I decided to do my own homework before I hold my nose and cast my lot with one of these enthusiastic insurance companies. And here’s what I found about the basics of Medicare in a nutshell.

What is Medicare?

Basic Medicare is a national health insurance program in the U.S., unveiled in 1966 under the auspices of the Social Security Administration (SSA). Today It’s administered by the Centers for Medicare and Medicaid Services (CMS). The prime objective is to provide health insurance for Americans 65 and older, but also is available for some younger people with disability status as determined by the Social Security Administration. People with end stage renal disease and amyotrophic lateral sclerosis may also sign up. Why were these two conditions designated out of the hundreds of worthy ones? Roll of the congressional dice, I suppose.

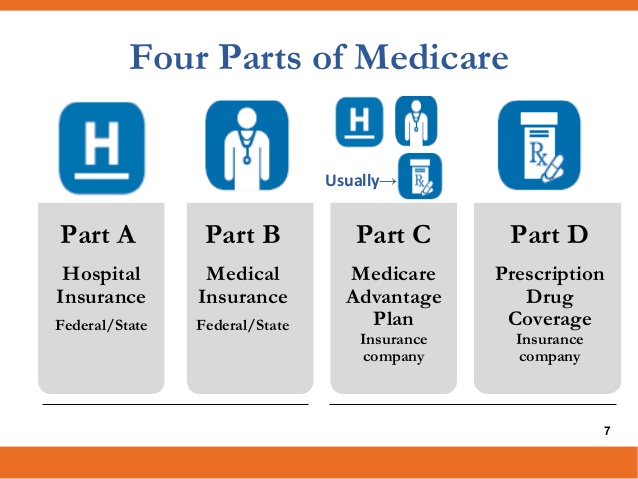

Like most government programs, misconceptions abound. When one can obfuscate, do so, ye civil service power-trippers. First, let’s be clear — Medicare isn’t free (for the most part), and the costs involved are often surprising to those who aren’t familiar with the program. Medicare enrollees cough up a variety of financial charges, including co-payments, coinsurance percentages, and monthly premiums. Although many thought Bernie Sanders‘ Medicare-for-all would be “free,” Berniecare was really just Obamacare with lipstick. And a bigger price tag. Beyond the basic Medicare Part A, there are 3 add-on parts, B, C, and D.

Medicare Parts

- Medicare Part A. Medicare Part A is hospital health insurance offered by the federal government to U.S. citizens and legal immigrants who have permanently lived in the U.S. without a break for at least five years. You usually don’t have pay a monthly premium to get Medicare Part A (Hospital Insurance) coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. In this case it’s called called “premium-free Part A.” People who don’t qualify for premium-free Part A can purchase Part A. If you do, you’ll pay up to a whopping $458 each month according to Medicare.gov. If you paid Medicare taxes for fewer than 30 quarters, the standard Part A premium will set you back $458. But if you paid into Medicare taxes for 30-39 quarters, then the standard Part A premium is $252. Keep in mind that if purchase Part A, you must also have Medicare Part B (Medical Insurance) and pay monthly premiums for both Part A and Part B.

- Medicare Part B. Medicare Part B is medical insurance and is part of Original Medicare and covers medical services and supplies that are medically necessary to treat your health condition. This can include outpatient care, preventive services, ambulance services, and durable medical equipment. Specifically, doctor’s office visits, lab work, x-rays, and outpatient surgeries, and preventive services to keep you healthy, like cancer screenings and flu shots. In 2020 the standard premium amount is $144.60 per month for individuals who filed individual taxes up to $87,000 or less, and those that filed jointly for $174,000 or less.

- Medicare Part C. According to the U.S. Department of Health and Human Services, “A Medicare Advantage Plan (like an HMO or PPO) is another Medicare health plan choice you may have as part of Medicare. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private companies approved by Medicare. If you join a Medicare Advantage Plan, the plan will provide all of your Part A (Hospital Insurance) and Part B (Medical Insurance) coverage. Medicare Advantage Plans may offer extra coverage, such as vision, hearing, dental, and/or health and wellness programs. Most include Medicare prescription drug coverage (Part D). Medicare pays a fixed amount for your care every month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare. However, each Medicare Advantage Plan can charge different out-of-pocket costs and have different rules for how you get services (like whether you need a referral to see a specialist or if you have to go to only doctors, facilities, or suppliers that belong to the plan for non‑emergency or non-urgent care). These rules can change each year.” I suspect this is the type of plan Joe Namath hypes in his commercial. Obviously the price will vary depending on services.

- Medicare Part D. Part D offers prescription drug coverage. Generally, you should only opt for this if you do not have employer or union drug coverage. Medicare.gov says, “If you join a Medicare Prescription Drug Plan, you, your spouse, or your dependents may lose your employer or union health coverage.” How much does it cost? The short answer is — it depends. Most Medicare Prescription Drug Plans charge a monthly fee that varies by plan. You pay this in addition to the Medicare Part B Premium. If you join a Medicare Advantage Plan (Part C) or Medicare Cost Plan that includes Medicare prescription drug coverage, the plan’s monthly premium may include an amount for drug coverage.

How to Sign-Up for Medicare

This is easy to do on-line. I did it this morning and it took about 30 minutes. I could have done it faster but half the time I spent cross-checking my answers. It’s a government input site so there are no do-overs once they give you the chance to review and “Do you really want to continue?” OK, go to the Social Security website and click on my Social Security. When it opens click on Create an Account. When that loads, click on Create New Account. Next, just keep following the meandering path you are led upon.

Did this article clear up some confusion on the basics of Medicare? I hope so. They don’t make it easy, do they?

Got a blog or website? Want more revenue? Monetize it!

Trending Articles

- Remodeling a Home for Disabled Homeowners

- Why Pandemics Like COVID-19, or Coronavirus Persist

- Blue Light, Eye Health, and Sleep

- How Health Care Systems Use Clinical Empathy to Support Patients

- A Compilation of Pet Peeves

- Insomnia – Symptoms, Causes, Myths

- Running Improves Memory, Brain Cells

References

Looking for more great content? Visit our partner sites:

I offer article and blog-writing services. Interested? Hire Me!

Did you find this article helpful? Millions of readers rely on information on this blog and our main site to stay informed and find meaningful solutions. Please chip in as little as $3 to keep this site free for all.

Visit Kelly’s profile on Pinterest.

About the Author:

![]() Kelly R. Smith is an Air Force veteran and was a commercial carpenter for 20 years before returning to night school at the University of Houston where he earned a Bachelor’s Degree in Computer Science. After working at NASA for a few years, he went on to develop software for the transportation, financial, and energy-trading industries. He has been writing, in one capacity or another, since he could hold a pencil. As a freelance writer now, he specializes in producing articles and blog content for a variety of clients. His personal blog is at Considered Opinions Blog where he muses on many different topics.

Kelly R. Smith is an Air Force veteran and was a commercial carpenter for 20 years before returning to night school at the University of Houston where he earned a Bachelor’s Degree in Computer Science. After working at NASA for a few years, he went on to develop software for the transportation, financial, and energy-trading industries. He has been writing, in one capacity or another, since he could hold a pencil. As a freelance writer now, he specializes in producing articles and blog content for a variety of clients. His personal blog is at Considered Opinions Blog where he muses on many different topics.

If there is a way for congress to make things complicated they will.

At least the liberal ones in Big Insurance’s back pocket.

All of them, Bessie.

What happens if you don’t sign up when they say?

I’m getting a lot of junk mail on medicare to. Someone is staying busy trolling public records for birthdays!

Why doesn’t the gov make this info private? We own our SS number why not our birthdate?

What you can find out online is craycray.

Essentially, most Medicare Advantage plans include prescription drug coverage. With Original Medicare, you must purchase a separate policy if you want a prescription drug plan. Medicare Advantage plans come with prescription drug coverage. Medicare Advantage plans often also come with extra coverage for services like chiropractic care, acupuncture, dental care, vision, hearing, and services outside the United States.